Financial Literacy and Empathy in the Age of Social Media

In the quaint Riverland primary school, nestled amidst the verdant landscapes, Anna Strachan, a dedicated counsellor, is leading an essential discourse on financial literacy for young minds. Amidst the clamor of social media trends and the relentless pressure to conform, Strachan underscores the urgency of equipping children with the tools to navigate these challenges.

The Unspoken Curriculum

Anna Strachan, a seasoned counsellor at Riverland primary school, is advocating for a new kind of education. She believes that financial literacy should be an integral part of the curriculum, especially in today’s digital age where social media trends exert a powerful influence on young minds.

Strachan emphasizes the importance of parents engaging their children in discussions about current events and teaching them empathy towards those who can’t afford or choose not to buy trendy items. She explains, “Children are constantly bombarded with images of the latest gadgets, clothes, and toys on social media. It’s crucial that we equip them with the understanding and resilience to cope with these pressures.”

Claire Eaton, a former teacher, echoes Strachan’s sentiments. She highlights that teenagers are often driven by the dopamine rush of buying the latest trends instead of rational thinking, which comes with a fully developed frontal lobe in their early to mid-20s.

Budgeting Apps: A Digital Lifeline

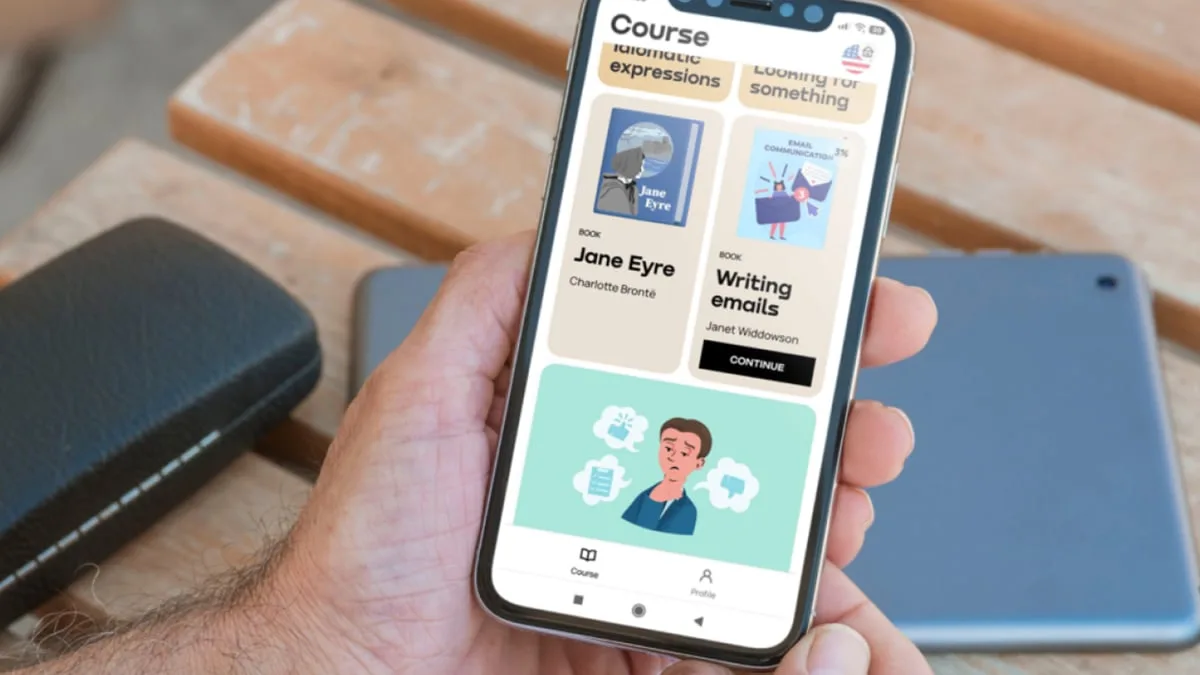

In a world where technology permeates every aspect of life, budgeting apps have emerged as a digital lifeline for many. A recent survey titled ‘Budgeting Apps’ aimed to understand the usage, preferences, and satisfaction levels related to these apps.

The survey collected responses from a diverse group of participants, covering key areas such as frequency of usage, features preference, current app usage, satisfaction levels, and reasons for app usage. The insights gathered from this survey will help budgeting app developers and companies refine their offerings to meet user expectations and enhance the overall user experience.

Eaton believes that such apps can be instrumental in teaching children about money management. “Parents could offer to pay a certain amount for a desired item and encourage their children to raise the rest using a budgeting app. This way, they learn the value of budgeting and hard work,” she suggests.

Empathy and Empowerment

Eaton advises parents to normalize the emotions associated with wanting to buy the latest trends and use these moments as an opportunity to have open conversations about money and financial empathy. “It’s not about depriving them but empowering them with knowledge and skills,” she asserts.

Strachan agrees, adding, “By teaching children empathy and financial literacy, we’re giving them tools to navigate the complexities of the modern world. We’re helping them understand that it’s okay not to keep up with every trend and that true value lies in understanding and respecting others’ choices.”

As the sun sets over Riverland, Strachan’s words resonate in the halls of the school, carrying with them a message of hope and empowerment. In the face of relentless social media pressures, the seeds of financial literacy and empathy are being sown, promising a future where young minds can make informed decisions and show compassion towards others.

The significance of budgeting apps in managing personal finances effectively, particularly for youth coping with social media pressures, is underscored by the recent survey. The insights gathered will undoubtedly play a pivotal role in refining these digital tools, making them even more effective in promoting financial literacy and empathy among the younger generation.

In Riverland primary school, Anna Strachan continues her mission to educate young minds about financial empathy and literacy. With each conversation, each lesson, she is helping shape a generation that understands the true value of money and the importance of empathy in a world driven by consumerism and social media trends.